The Rent vs. Buy Decision & Calculation

by Patrick Carlisle, Chief Market Analyst, Compass

Though a legitimate calculation, the rent vs. buy decision isn’t fundamentally based on comparing the current rent on a property to the initial monthly cost of owning it: More meaningfully, the financial decision pertains to total cost over time and, especially, how to best build household wealth. As will be reviewed, there are multiple dynamics at play, but long-term, fixed-rate loans + the ability to refinance, and, in particular, home-price appreciation have historically been the biggest game-changers in the calculation.

Perhaps more than any other decision, buying a home combines deeply personal, quality of life and life-planning issues and substantial financial considerations—which only you can weigh according to your own circumstances, plans and priorities, and your projection of what the future holds.

Comparing the exact financials of renting vs. buying over time is challenging, because the calculation depends on predicting a number of complex, often volatile economic factors, including:

- rental-cost appreciation over the period of projected home ownership

- the return one could generate on one’s downpayment monies if invested instead of being used to buy a home

- total home price appreciation over the period of ownership

- inflation over the period

- mortgage interest rates, at purchase and in the future

There are a number of rent vs. buy calculators available, a few listed below. But any calculation is predicated on taking a stab at what’s going to happen in the future with factors that, as we have seen in recent years, can change quickly and dramatically. Certainly reviewing current economic and market conditions, and looking a past trends is useful – for example, annual real estate appreciation rates over the past 10 or 20 years – but even then, the calculations will depend on the exact period used to calculate past performance, and, of course, the future may not replicate the past. Consulting qualified financial, mortgage and real estate advisors is always a good idea.

The default economic assumptions built into the sample rent vs. buy calculators below are open to debate but can be adjusted as one runs different scenarios. (Small changes in assumptions can lead to substantially different results.) Following the calculator links is an exploration of some of the financial issues pertinent to the home buying decision.

https://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html

https://www.realtor.com/mortgage/tools/rent-or-buy-calculator/

https://www.calculator.net/rent-vs-buy-calculator.html

https://www.nerdwallet.com/mortgages/rent-vs-buy-calculator

Homeownership as an Investment

“Renting can make sense as a lifestyle choice or because of income constraints. As a means to building wealth, however, there is no practical substitute for homeownership.”

“Homeownership and Wealth Creation,” editorial in The New York Times*

Typically, the purchase of a home is the largest or one of the largest financial transactions of one’s life, and has often been a very good or even spectacular investment, especially over the longer term. Below are some of the reasons why this has often been the case:

- Long-term home-price appreciation trends: January 2000 – December 2022, the national house price appreciated approximately 197% according to the S&P CoreLogic Case-Shiller Home Price Index vs. a consumer-price inflation rate of approximately 70% to 75%.** (Appreciation rates vary widely between different markets and over different periods of time – some metro areas saw higher or lower rates, and the calculation depends on the exact period being measured. Case-Shiller metro-area appreciation rates)

- Leverage: The option to finance much of the purchase price can supercharge the return on one’s cash downpayment and closing costs if values increase. Appreciation (or simple inflation) occurs on the full value of the home, multiplying the return on, for example, a 20% downpayment.

- The ability to lock in your mortgage payment: With a fixed-rate mortgage, a major portion of one’s housing costs remains stable for the entire period of the loan, while rents, outside one’s control, typically increase significantly over time. As the years or decades pass, this can add very substantially to the financial benefit of owning vs. renting. The option to refinance into a new, lower-interest fixed rate loan, if the opportunity occurs, adds greatly to this benefit. According to a U.S. Census study, virtually across the country, renters are more likely than homeowners to spend a larger percentage of their income on housing.**

- The “forced savings” effect: Besides potential appreciation gains, paying – having to pay – one’s monthly mortgage payment increases home equity as the outstanding loan is gradually paid down, an effect that accelerates over the life of the loan. While rents are basically money spent and gone, monthly mortgage payments can quietly turn into very large, equity-based, financial assets.

- The potential tax deductibility of certain costs of homeownership.

- The $250,000/$500,000 exclusion on home-appreciation capital gains taxation – a rare case in which one can avoid paying taxes on potentially large gains.

- The option of potentially turning your home into a rental property down the road, while keeping your existing long-term, fixed-rate home loan.

Please see important notes at the end of this article.

Some other thoughts for consideration:

- The home you purchase should work for you now – at minimum, fulfilling your basic housing requirements at an affordable monthly cost. (A huge factor in the post-2008 crisis was millions of households buying or refinancing homes with loans they couldn’t afford in the first place – encouraged by predatory lending practices.)

- Keep a reserve fund in case of the unexpected developments that can come up.

- Buying for the longer term is generally safer as an investment: Though it can sometimes be profitable, buying and selling over shorter periods often carries greater risks and means that loan and closing costs will be amortized differently.

- Consider refinancing your existing mortgage into new, fixed-rate loans when significantly lower rates make this sensible per your expected timeline of ownership. This can be an enormous financial advantage, but avoid using your home as an ATM in times of appreciation, especially for non-essentials.

Owning one’s home has aspects beyond the financial that, for many, can be just as important: Security, independence, control, privacy, pride of ownership and the ability to make changes and improvements according to your own tastes and needs.

Link to Compass National Market & Economic Indicators Report

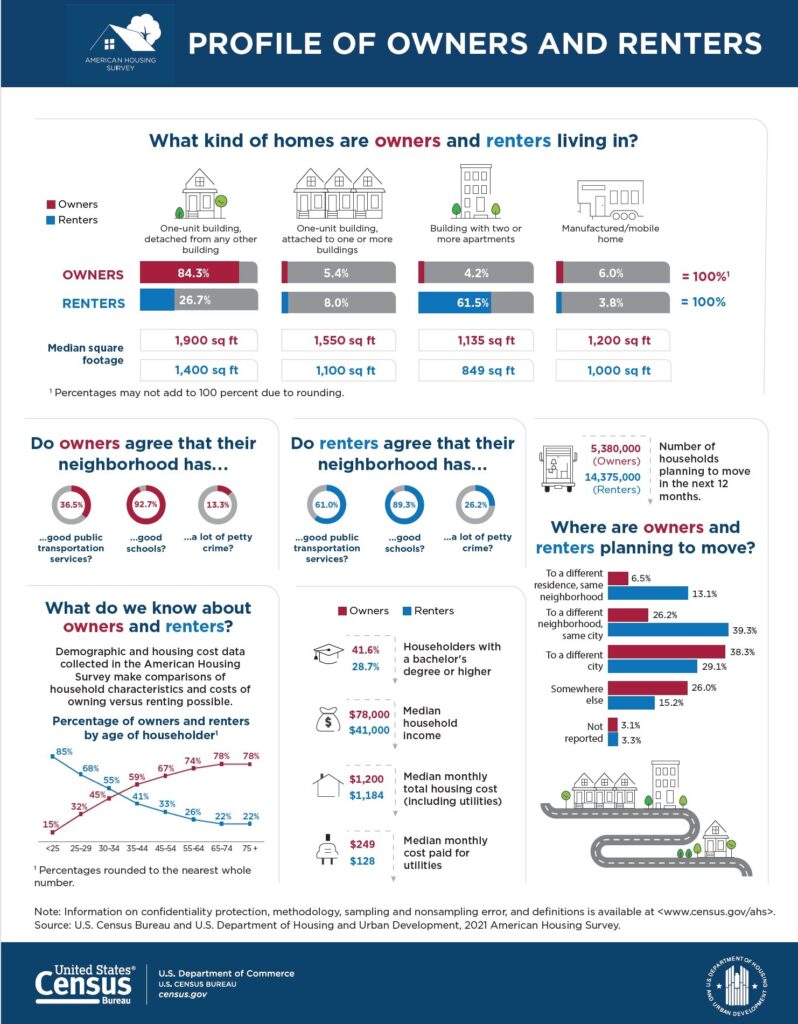

The above graphic comes from the Census article, Owning or Renting the American Dream, which contains a lot of interesting data on U.S. housing trends and statistics.

*The New York Times Editorial, 11/30/2014, “Homeownership & Wealth Creation”

** 2000-2022 national house-price appreciation rates per the S&P CoreLogic Case-Shiller Home Price Index: https://fred.stlouisfed.org/series/CSUSHPISA.

Inflation rate data referenced: https://www.usinflationcalculator.com/

Link to U.S. Census article regarding the income burden of housing on renters vs. homeowners

Important Notes: Consult a qualified financial planner or accountant regarding tax-law and other financial issues pertinent to buying, owning, refinancing, renting or selling a home. Tax law is subject to change, and representations regarding tax law must be confirmed with a qualified professional as applicable to your specific circumstances. Renting out your home may affect the

$250,000/$500,000 exclusion on capital gains taxes. Real estate agents are not qualified to advise on legal and tax matters.

Home prices can flatten or decline as well as increase, and different regions, market segments and property types have historically experienced wide variations in appreciation. Every financial investment is subject to risks. Real estate markets can be affected, positively or negatively, by a wide range of ever-changing economic, political, social, demographic and environmental factors. As with any investment, the timing of one’s purchase and sale affects the financial calculation: Markets typically move in cycles, and though, over the longer term, these cycles have generally, historically, moved in the direction of increasing home values, if one is forced to sell during a market recession, it will negatively affect investment returns. Past performance is not a guarantee of future results. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers should be considered approximate, and confirmed independently according to one’s specific circumstances. Compass is a real estate broker licensed by the states in which it practices.