With the New Year comes many changes to laws and how they affect real estate. You have probably heard about the new tax law in one form or another, but that is not the only thing that will affect buying or selling a home this year. Below are some of the things that you should know.

Tax Cuts & Jobs Act

Passed in December of 2017, various aspects of the law have been circulating for months and there is a lot of confusion between the proposed House Bill, Senate Bill, and what became law. Let’s clear things up.

- Mortgage Interest Deduction

- State and Local Taxes (SALT)

- Capital Gains Exclusion

- 1031 Exchanges

- Pass Through Entities

Original Proposal: Reduce the limit on the mortgage interest deduction (MID) amount from $1,000,000 to $500,000

New Tax Code: Limits mortgages deductions to the first $750,000 of a loan, down from the $1m previously. Existing mortgages up to $1,000,000 are grandfathered in.

How This Affects You: The new law only applies to mortgages taken out after December 14, 2017. Assuming 20% down, only purchases of approximately $938,000 or under will receive the full tax write-off for interest. Any purchase over $938,000 will lose their interest deduction over the $750,000. This is partial / completely offset by the doubling of the standard deduction to $12,000 for individuals and $24,000 to married couples.

Original Proposal: Elimination of state and local tax deductions (including property taxes)

New Tax Code: Allows an itemized deduction of up to $10,000 for the total of state and local property taxes, and income or sales taxes.

How This Affects You: Here in the Bay Area, this can make a substantial impact on what can be deducted because of our higher state income state and property taxes of up to ~1.75%. Many home buyers will lose the ability to deduct all their state and local taxes, resulting in a higher cost of homeownership. This is partial / completely offset by the doubling of the standard deduction to $12,000 for individuals and $24,000 to married couples.

Original Proposal: Owners would need to live in their home for at least 5 out of the last 8 years to claim this exemption. Under old tax framework, a typical owner would only need to live in their home for two out of the last five years to claim a $250,000 exemption per homeowner and up to $500,000 per couple.

New Tax Code: No change.

How This Affects You: No effect. The original tax framework remains in place.

Original Proposal: Elimination of 1031 Exchanges.

New Tax Code: No change.

How This Affects You: No effect. 1031 Exchanges are still in place.

Original Proposal: No change.

New Tax Code: Allows for up to 20% deduction for pass-through entities.

How This Affects You: If you own investment property or are a real estate professional. You may qualify for up to 20% deduction on your pass-through income. The deduction phases out at $315k of annual income for couples.

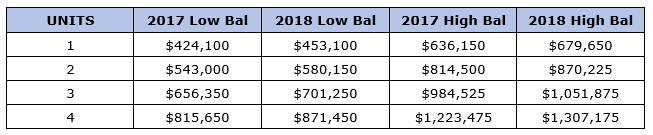

New Conforming Loan Limits

Another item that changed before the New Year were new conforming loan limits.

Source: JVMLending.com

How This Affects You: More people will qualify for a conforming or high balance conforming loan rather than a jumbo loan. This can mean better rates, less stringent requirements for qualification, faster closing, and lower down payment options.

*This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.